Usain Bolt's Involvement in SSL Fraud Case Raises Concerns over Foreign Investments in Jamaica, Economist Warns

February 16, 2025

Controversy surrounds Usain Bolt's involvement in the US$30-million fraud at Stocks & Securities Limited (SSL), potentially impacting Jamaica's foreign investments. Economist Keenan Falconer discusses the implications on investor sentiment.

The controversy surrounding the defrauding of sprint great Usain Bolt and hundreds of other clients of Stocks & Securities Limited (SSL) could trigger a reduction in foreign investments in Jamaica if aspects of the case draw international eyes, economist Keenan Falconer believes.

Bolt was among 200 SSL clients impacted by the US$30-million fraud, authorities disclosed. The track and field legend, through his holding company Welljen Limited, reportedly invested US$6.2 million in SSL.

Falconer said Bolt has been more than reasonably restrained in his public commentary on the matter, acknowledging loyalty to Jamaica.

However, the economist said given Bolt’s profile, if he decides to reverse his stance, this could amplify adverse sentiments that may have already been held by elements in the international community in the immediate aftermath of the incident.

The fraud at the investment firm was first reported publicly in January 2023.

“Matters in the financial world depend to a large extent on the power of perception. So, if negative signals are sent globally, that could impact metrics like investor sentiment, credit ratings and willingness to do business, even if those may not be directly related to the nature of this incident,” Falconer explained to The Gleaner yesterday.

His comments come amid resurfaced discourse on the matter after Bolt expressed displeasure with the Jamaican Government’s efforts and the pace at which the SSL fraud case is progressing in an interview with The Fix on Monday.

Bolt said he has not invested locally since being defrauded.

Falconer said although the incident has “no implications” for wider financial sector stability, questions may arise about the robustness of Jamaica’s regulatory regime and the ability to resolve such matters in a timely and satisfactory manner should there be a reoccurrence.

“That also impacts perceptions of institutional rigour and desire to engage with domestic entities. So it is really in the best interest of the competent authorities to quicken the pace of recovery, not only in respect of Usain but all who were affected in order to restore any potentially lost confidence,” the economist noted.

Yesterday, Bolt’s attorney Linton Gordon rebuffed allegations being circulated that only a portion of Bolt’s funds that were sent to SSL were received by the institution.

He said the allegation, reported by one media house, is “false, baseless, and entirely without credibility”.

Gordon said all funds lodged at SSL by Bolt’s company were transferred via bank transactions and that every payment was acknowledged by the institution in writing.

Further, he said Ken Tomlinson, who was appointed by the Financial Services Commission (FSC) to take temporary management of SSL, found records confirming these lodgements and has attested to them in the Supreme Court.

“Therefore, any suggestion that funds from Mr Bolt’s company, Welljen Ltd, did not reach SSL is inaccurate and without merit,” said Gordon.

He also said the notion that Bolt was negligent in making these deposits is unfounded.

“The prime minister of Jamaica, the Government of Jamaica, and hundreds of Jamaicans invested in SSL – an institution which was approved and regulated by the Government,” the attorney said.

“To suggest that Mr Bolt was careless or lacked proper financial management is to imply the same about every Jamaican who has invested in a government-approved financial institution.”

Gordon noted that the FSC issued SSL an annual licence to operate as a financial institution and said on that basis, every citizen has the right to rely on the government entity that is responsible for assessing and regulating such institutions.

“There now appears to be an organised effort to shift blame on to the Honourable Usain Bolt for his loss when he is guilty of nothing more than investing in the country that he loves. This is a textbook case of victim-blaming and it appears to be an attempt to absolve the Government of its failure to protect the public and those defrauded by SSL,” the attorney stated.

“Even more concerning is the apparent attempt to silence victims and manipulate the narrative about who is truly responsible for this large-scale fraud, which has left hundreds of Jamaicans without their hard-earned money and no clear path to recovery.”

Gordon said the Government had announced that it invited experts from the United States and the United Kingdom to conduct audits and investigations into the operations of SSL but said the results of these audits and investigations have not been shared with Bolt or him.

“However, based on reports circulating in the media, it appears that parts of the investigation are being shared with a certain media house, including what purports to be information touching and concerning our client’s account at SSL; information that is confidential and entitled to protection under the law,” he noted.

“We are currently reviewing some of the statements that have been made and will advise our client on the legal actions available to him.” (Jamaica Gleaner)

Exciting Action in BABA Premier League at the Barbados Community College: Lakers and Celtics Prevail in Thrilling Games

April 6, 2025

Measles Outbreak Claims Second Child in Western Texas as Cases Continue to Rise

April 6, 2025

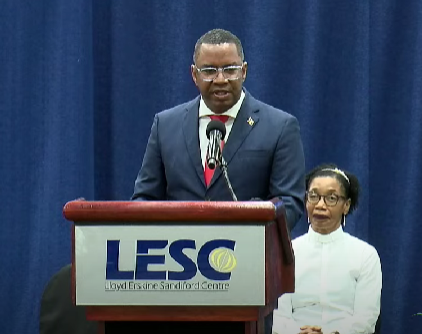

Minister Appeals for Public Cooperation with Police Amid Rising Violent Crime in Barbados

April 6, 2025