Ministry of Finance Seeks $324.3 Million in Unidentified Funding for Fiscal Year's Second Half

Government faces a funding gap of $324.3 million for the second half of the fiscal year, with potential risks due to revenue shortfalls or increased spending. Various financing options are being considered.

Government needs $324.3 million to meet the spending it has budgeted for the second half of its fiscal year ending March 31.

The Mid-Year Review Report prepared by the Ministry of Finance says this funding “remains unidentified” and could “worsen in the event of lower than expected revenue or elevated spending”.

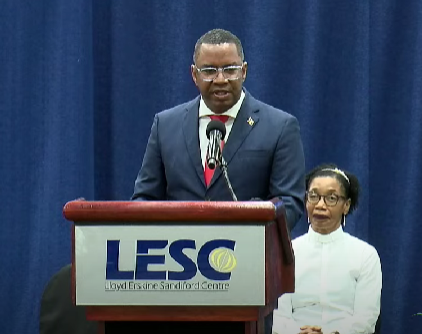

The report, which Minister in the Ministry of Finance Ryan Straughn laid in Parliament, stated that the expected financing required for the second half of the fiscal year was estimated at $1.03 billion, “of which $324.3 remains unidentified”.

“During the remainder of fiscal year 2024/25, revenue and expenditure are expected to total $1.6 billion and $2.1 billion, respectively, resulting in a fiscal deficit of $449.8 million between October 2024 and March 2025. Additionally, outflows are projected to total $583.7 million,” it added.

Government has identified a number of options that it anticipates will “aid in supporting the financing requirement for the latter half of fiscal year 2024/25”.

Those it highlighted included $113.5 million in policy financing from the International Monetary Fund (IMF) in the third quarter and $200 million from the Inter-American Development Bank (IDB) in the fourth quarter.

The Ministry of Finance also identified project funds totalling $79.7 million and said that net treasury bill proceeds are expected to generate $87.5 million, while BOSS+ bonds and savings bonds are projected to yield $30.2 million and $37.2 million, respectively. However, the report noted that there were downside risks to the financing projections.

“Unidentified financing for the remainder of the fiscal year could worsen in the event of lower than expected revenue or elevated spending. The financing position also hinges on appetite for Government securities.

“A slow rate of purchase of BOSS+ bonds or savings bonds would reduce the amount of financing available during the forecast period. The forecast for the last six months of fiscal year 2024/25 also assumes at least $24.2 million in project funds will be withdrawn from deposits, contingent on successful project implementation,” it stated.

The Mid-Term Review said Government’s financing needs were successfully met in the first half of fiscal year 2024/25, which started on April 1.

“Between April and September 2024, Government’s cash operations culminated in a fiscal deficit of $95.3 million. Outflows of $365.9 million also contributed to the financing requirement [of] $461.2 million,” the report outlined.

“A combination of sources was used to accommodate the Government’s financial obligations for the first half of the year.

“Fiscal year 2024/25 began with $482.4 million in deposits which rolled over from the previous fiscal year and were bolstered by the receipt of $9.7 million in project funds from the IDB and $111.9 million in policy funds from the IMF through the Extended Fund Facility and Resilience and Sustainability Fund arrangements.”

The report also said that activity on the money and bond markets during the first six months of fiscal year 2024/25 “yielded $110.3 million in net treasury bill proceeds, while the second tranche of BOSS+ bonds generated $30.3 million in proceeds”.

Government also made use of the temporary borrowing facility with the Central Bank, “increasing the ways and means stock by $52.5 million”.