Barbados' 2024-2025 Mid-Year Review Reveals Revenue Surpasses Expectations by 12.5%

November 27, 2024

Barbados surpasses revenue expectations for 2024-2025 fiscal year by 12.5%, driven by strong corporate tax and property tax collections. VAT receipts fall short due to higher refunds, but economy remains positive.

Barbados’ revenue collection for the first half of the 2024 to 2025 fiscal year has outpaced expectations by 12.5 per cent, achieving a “stronger-than-expected” profit performance.

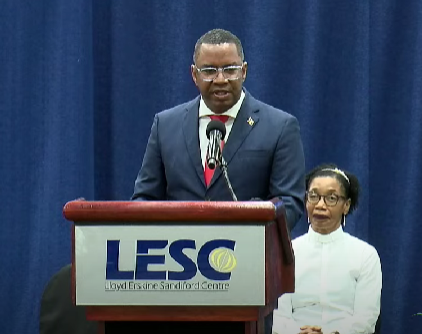

This was revealed on Tuesday in a ministerial statement delivered in Parliament by Minister in the Ministry of Finance Ryan Straughn, who highlighted key segments of the mid-year review as mandated by the Public Finance Management Act 2019.

He shared that the government collected some $1.87 billion in revenue during the period, surpassing the forecast of $1.66 billion. Corporate tax receipts played a major role, bringing in $384.49 million, some $147.22 million more than anticipated.

Property taxes also exceeded expectations, totaling $180 million, nearly double the forecast of $86.47 million.

“This overperformance was mainly due to net land tax receipts exceeding the mid-year target by $85.87 million, owing to the earlier issuance of land tax bills,” Straughn explained.

Despite these gains, he revealed that Value Added Tax (VAT) receipts fell short of projections, amounting to $524.55 million, which was more than $30 million below target. The minister attributed this shortfall to higher-than-expected refunds but noted that strong domestic consumption, fueled by a recovery in tourism and improved consumer confidence, has kept the economy on a positive trajectory.

The mid-year report also highlighted restrained government expenditure, which stood at $1.70 billion, falling short of the forecasted $1.763 billion. Straughn shared that the underperformance in expenditure was mainly due to delays in capital project execution, particularly in infrastructure projects such as road repairs and housing developments.

He noted the government’s fiscal responsibility, sharing that the country achieved a fiscal surplus of $169.38 million, or 1.16 per cent of GDP, compared to a forecasted deficit of $100.32 million.

“This significant improvement reflects the overperformance in revenue and controlled expenditure,” he said.

Straughn further noted the revised fiscal framework projects total revenue for the financial year at $3.543 billion, while total expenditure is expected to reach $3.78 billion. That, according to him, reflects anticipated increases in capital works during the second half of the year.

Straughn underscored the continued commitment of the government to invest in critical infrastructure projects such as the Geriatric Hospital and road rehabilitation programmes, which he said are expected to drive additional growth.

The government economist reiterated that the economy is projected to grow by 3.9 per cent in the period ending in 2025, led by the tourism and construction sectors.

Touching on public debt, Minister Straughn reported that as of September 30, 2024, Barbados’ total public debt stood at $14.878 billion, or 104.8 per cent of GDP.

He reaffirmed the government’s commitment to responsible debt management, including timely debt service payments which totalled $717.8 million during the first half of the financial year.

“Our focus on public sector reform, debt management, and prudent fiscal policies will ensure that Barbados remains on a sustainable fiscal path whilst continuing to invest in the future of our people and our country,” Straughn said.

During his review, the minister also noted efforts to enhance tax administration, reduce arrears, and improve the efficiency of state-owned enterprises. These reforms, he said, have already yielded results, contributing to the positive revenue performance.

Straughn noted the Mia Mottley administration’s optimism about meeting its targets under the Barbados Economic Recovery and Transformation Plan.

“The achievements of the first half of the fiscal year give us confidence that we are on track to meet our targets, and the government will continue to work tirelessly to ensure that these targets are met,” he said.