Maximizing Business Success Through Today's Technological Landscape: Strategies for Growth and Competitiveness

October 29, 2024

Explore strategies for business growth and competitiveness through fostering innovation and adapting to the technology-driven landscape. Learn about the Doing Business index and operational excellence through technology for enhanced efficiency and competitiveness.

Last week, we explored creative destruction and fostering a culture of innovation as essential strategies for enhancing business growth and competitiveness. Today, we’ll examine what it means to conduct business effectively in today’s technology-driven landscape, focusing on both external factors and internal strategies that drive success.

Understanding the Business Environment

The Doing Business index, or Ease of Doing Business (EoDB) index, was a World Bank initiative that assessed business environments in 190 economies through 10 key areas: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting investors, paying taxes, trading across borders, enforcing contracts, and resolving insolvency. Higher rankings reflect a more favourable business environment, marked by streamlined regulations and strengthened property rights, largely influenced by government policies and initiatives. With Barbados ranked 128th, there is significant room for progress, particularly when compared to regional peers like Jamaica (71st), Antigua and Barbuda (113th), Dominica (111th), and Saint Lucia (93rd). This contrast highlights the competitive challenges Barbados faces in attracting and sustaining business investment.

Driving Operational Excellence Through Technology

While there isn’t a direct equivalent to the Doing Business index for the private sector, companies can focus on core elements that drive competitiveness and efficiency. I firmly believe that the greatest potential for private sector progress lies in operational efficiency. By streamlining processes through automation and lean methods, companies can significantly reduce costs and boost productivity. Digital tools like Business Management Software (BMS) platforms, such as Zoho and QuickBooks for SMBs, and more comprehensive Enterprise Resource Planning (ERP) systems like SAP and Oracle NetSuite for larger enterprises, provide invaluable access to data and customer insights—the essential fuel for artificial intelligence in business.

The Customer-Centric Revolution

Understanding and responding to customer needs has never been more critical. If email was the “killer app” of the Internet’s early days, mobile phones became the transformative tool that redefined connectivity in the digital age. Today, mobile loyalty apps continue this transformation, offering an almost instantaneous way to build customer loyalty. Imagine replacing traditional loyalty stamps with points stored and redeemed via a mobile app each time you visit your favourite restaurant for a smoothie or meal.

These apps could not only log visit frequency but also track dietary preferences, enabling businesses to suggest tailored menu options on promotional days. Picture it: the app remembers your anniversary, offering a special discount and reserving your favourite table if you book in advance. This approach is more efficient and allows businesses to deliver real-time, personalised offers, extending well beyond the reach and immediacy of social media alone.

Leadership and Innovation Management

Achieving the best outcomes from a customer-centric approach calls for a dedicated Business Innovation Officer—a role we discussed last week. This leader is essential for developing strategies, technologies, and processes that drive growth and maintain competitiveness. They would identify such opportunities, oversee digital transformation efforts, and ensure that the customer experience evolves in step with advancements in innovation.

Financial Management and Regulatory Compliance

Financial management and regulatory compliance form the backbone of sustainable business operations. Cash remains the lifeblood of any business, which explains why historically, the finance department was first to benefit from digital transformation. Strong credit management and real-time financial tools support growth—precisely why most BMS platforms feature accounting as their core functionality. Proactive compliance and robust cybersecurity measures protect operations and build trust, a reality recognised by the Financial Services Commission’s ‘Technology and Cyber Risk Management Guidelines’, which outline policies and practices that financial institutions must adopt to mitigate technology and cyber risks.

Building Organisational Resilience

Workforce development through skill-building and positive work culture helps retain talent and drive performance. Similarly, supply chain resilience through diversified supplier relationships and logistics optimisation helps manage disruptions and improve efficiency. These internal strengths create a foundation for sustainable growth and market adaptability.

Environmental and Social Impact

Environmental responsibility and social initiatives have evolved from optional considerations to essential business practices. The Internet has ushered in the era of the global, socially aware consumer. These consumers are not only interested in competitive prices and quality products but are increasingly conscious of the social impact companies project—from the diversity of their boards of directors to the types of social programs they support.

Health and community empowerment initiatives, for example, resonate strongly, as consumers seek to align with brands that share these values.

In today’s competitive landscape, success hinges on the ability to integrate operational efficiency, customer-centricity, financial stewardship, workforce development, and social responsibility. While government policies play a vital role in shaping the business environment, the private sector must proactively adapt, embracing digital transformation, innovation, and ethical practices. By focusing on these core elements, companies not only enhance their own resilience and market position but also contribute to a stronger, more sustainable business ecosystem that meets the needs of a rapidly evolving, globally connected marketplace.

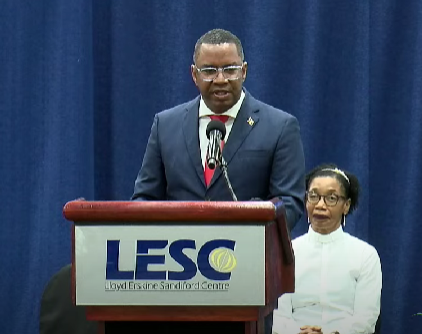

Steven Williams is the executive director of Sunisle Technology Solutions and the principal consultant at Data Privacy and Management Advisory Services. He is a former IT advisor to the Government’s Law Review Commission, focusing on the draft Cybercrime bill. He holds an MBA from the University of Durham and is certified as a chief information security officer by the EC Council and as a data protection officer by the Professional Evaluation and Certification Board (PECB). Steven can be reached at Mobile: 246-233-0090; Email: steven@dataprivacy.bb