Barbados Government Delays Immediate End to Two Per Cent Foreign Exchange Fee Despite IMF Recommendations

Government currently has no immediate plans to end the two per cent foreign exchange fee in Barbados, despite IMF recommendations. The fee has generated significant revenue for the government.

Government has no immediate plans to end the two per cent foreign exchange fee Barbadians pay whenever they conduct foreign exchange transactions.

This is despite a continued recommendation from the International Monetary Fund’s (IMF) Barbados staff mission team to do so.

Central Bank data shows that the fee, which was first introduced in 2017, has earned Government $493.3 million in revenue over the past six financial years. It added a further $52.9 million to the public purse between April and September.

In the IMF’s most recent Barbados country report published in June, the IMF staff advised: “With long-standing capital controls continuing to provide protection against capital outflows and a substantial improvement in macroeconomic conditions in recent years, the authorities should consider removing the foreign exchange fee introduced in 2017.”

At a press conference yesterday, mission chief for Barbados Michael Perks said the staff was still recommending the two per cent fee be ended.

“I think that’s the position, it’s been in successive [IMF Barbados country]

reports. Is it at this stage an absolutely macro-critical measure to push through? I don’t think so,” he added.

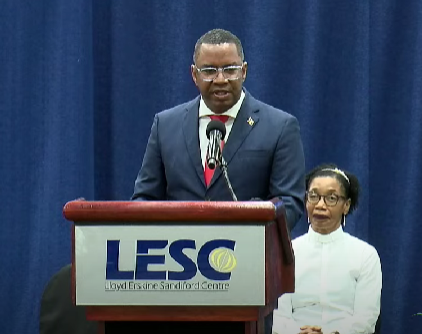

Minister in the Ministry of Finance Ryan Straughn said Government wanted to monitor the performance of the corporation tax reform measures before determining what it would do with the foreign exchange fee. This included not just the performance of the initial corporate tax change which took effect in January, but “into next year” in relation to the Qualified Domestic Minimum Top-up Tax that is linked to the global minimum tax regime.

“Now to be quite honest and fair, we have had . . . almost every year, some shock that causes us to have to spend more money and notwithstanding that, we’ve had access to financing, that [foreign exchange fee] has been a reliable revenue stream,” he said.

“Until we see the corporation tax and how that performs, I can’t tell you that we will revisit that anytime particularly soon, unless we are very comfortable that we have come out of this [challenging period].” (SC)