National Financial Literacy Programme Urges Barbadians to Plan, Budget, and Exercise Control While Shopping This Holiday Season

"Plan, budget, and exercise financial control this holiday season in Barbados. The National Financial Literacy Programme encourages responsible spending, saving, and wise use of credit cards."

As Barbadians go shopping this holiday season, the National Financial Literacy Programme (NFLP), is urging them to plan, make a budget and exercise control.

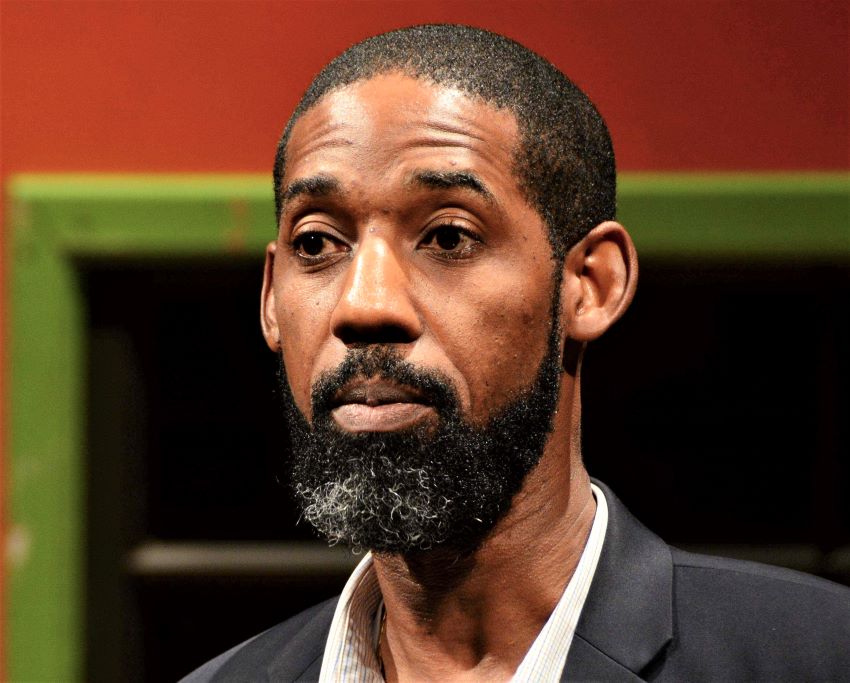

Consultant to the Ministry of Energy and Business’ Financial Literacy initiative and its National Coordinator, David Simpson, is encouraging those celebrating the season to do everything “responsibly and in moderation”.

Simpson said: “It can be a season of much temptation, but we must always keep our financial goals and habits in mind. Therefore, we must plan our Christmas spend, budget for gifts, food, decorations, curtains, among other things, and then follow the budget. This will be the longest pay period of the year and we have to stretch our money.

“Our message, therefore, is to set a strict budget; avoid impulse buying; understand loan and purchase terms thoroughly; resist pressure to overspend; compare prices before buying; pay your December bills before spending any money and plan for January.”

For those who will be receiving a bonus, the financial literacy consultant encourages them to spend it wisely and where possible, save or invest some or all of it. He also warned those with credit cards to use them wisely and only when necessary. “Do not splurge using your credit card. Again, plan, budget and follow it because the bill will come early next year,” he stated.

Simpson encouraged Barbadians to stay within their means and not start 2024 “behind the eight ball without cash in hand, or in unnecessary debt”.

“Make financial health and wellness a priority for 2024, and take advantage of information and tips that are being made available through the National Financial Literacy Programme, its stakeholders and partners,” he suggested.

Saving and investing, he noted, are critical to people’s financial wellness. He indicated that saving is a habit that allows people to put aside money for a clear objective, or for emergencies in the near future.

“Investing is a form of saving for a stated return that is higher than any saving interest rates, and allows an individual to grow the money invested over the short to medium-term, that is one to five years,” Simpson explained.

He stated that the National Financial Literacy Programme will be introducing a range of exciting activities, programmes and interactions in schools and communities in early 2024. These, he added, will be supported by a refashioned online public webinar series and ongoing interventions across communities.

(PR)