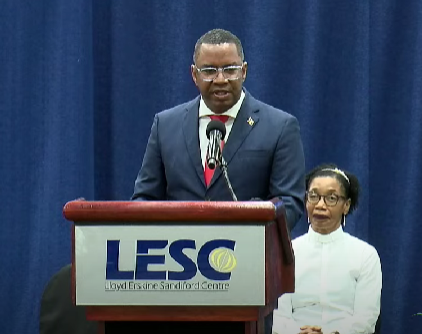

Central Bank Governor Greenidge Addresses Concerns Over Foreign Exchange Access for Overseas Investments

November 20, 2024

Central Bank Governor Dr Kevin Greenidge addresses concerns on accessing foreign exchange for overseas investments, citing ample reserves and ease of transactions through foreign currency accounts. Access through the Central Bank's Forex Online portal is available.

Concerns are being raised about investors being able to access foreign exchange for overseas investments, but Central Bank Governor Dr Kevin Greenidge says he has no evidence of such difficulties.

Greenidge told Eckler’s annual Investment Policy Review for Pension Plans Conference yesterday that there was $3.2 billion in foreign reserves at the end of September, and a further $1.2 billion in foreign currency accounts in commercial banks and other deposit takers.

However, Donna Every, a representative of the Republic Bank pension fund, asked Greenidge: “The economy is growing, we have a lot of reserves. Why is it still so difficult to access foreign exchange to do foreign investment which will bring revenue to the country?”

Idea

“I don’t see any evidence of that,” Greenidge told pension plan trustees and other conference participants during the session at the Lloyd Erskine Sandiford Centre.

“I don’t want you or anyone here to leave with the idea that we [have] got any problems with foreign exchange, or we are rationing foreign exchange, or that there is an issue investing overseas.”

The Governor added: “In the banking system itself, we have about $1.2 billion in foreign currency deposits, which in the past would have come to the Central Bank but now we allow persons to have a foreign currency account.”

“Any individual that owns a foreign currency account, the money is theirs to do whatever they want; they don’t require Central Bank approval to do it. So if you earn foreign currency and you put it in your foreign currency account, you can do it for any transaction – legally, of course.”

Applications to purchase foreign exchange can also be made using the Central Bank’s Forex Online foreign exchange application portal.

Peter Arender, Fortress Fund Managers chief executive officer and chief investment officer, also flagged the access issue.

He said that since Barbados did not have an investment grade credit rating, investment managers were unlikely to allocate large amounts of their portfolio here.

“Our market is tiny. It’s dominated by an improving credit in terms of the Government, but at a single B credit rating. We have to call a spade a spade and say if it weren’t the country in which we all live, would we want to put large amounts of our portfolio into any single B-rated bond, and I think the answer would typically be no,” he asserted.

Apply

“It boils down to we have trapped capital, and we’d love to find out if we can all organise ourselves and apply for the foreign exchange and that we’re wrong about this, and this has changed.”

Arender added: “I think we continue to face challenges here and as a society in balancing our use of foreign exchange for consumption versus our use of foreign exchange for long-term investment.

“We would firmly still be in the camp of those who would say that we really should, as a society, have mechanisms for doing not one, not the other, but both for everybody’s benefit – partly because this lack of access [to foreign exchange] has contributed already to underfunding of pensions.”

During his remarks, Greenidge urged pension plans to invest more in Barbados, especially now that the economy was growing.

“A growing economy creates fertile ground for strategic investments by pension funds. In particular, some areas would include climate resilience and sustainable infrastructure, investments that align with Barbados’ national priorities as expounded in the National Investment Plan,” he said. (SC)