Minister of State Highlights Importance of Financial Literacy for Seniors in Ensuring Comfortable Retirement

November 22, 2023

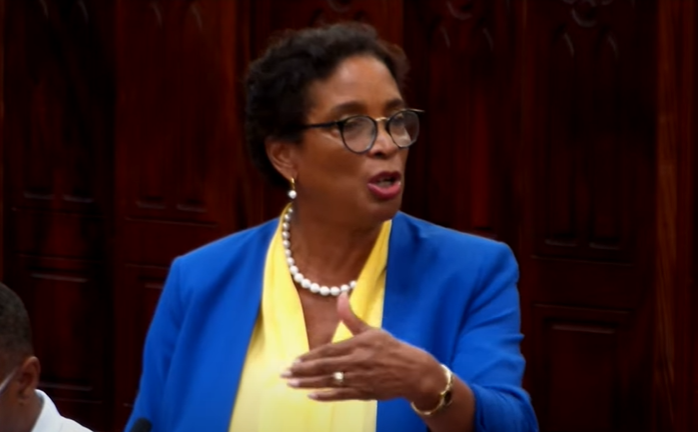

Minister Sandra Husbands advocates for teaching financial literacy to the elderly, emphasizing their struggle to manage finances and the need for precautions against abuse and retirement planning education.

Minister of State in Foreign Trade and Business Sandra Husbands has suggested financial literacy must be taught to the elderly so they can live comfortably in their old age.

She said one of the key lessons emerging from the COVID-19 pandemic was that seniors needed more financial education as many of them were finding it difficult to manage their financial affairs.

Speaking during debate in the House of Assembly on the National Insurance and Social Security (Amendment) (No. 2) Bill, 2023, Husbands, who has been emphasising the importance of teaching financial literacy to all segments of society, the St James South MP said: “We have so many seniors who right now are depending on their National Insurance pension, but with the rising cost of living, it is a struggle for them to manage on those funds. It’s a struggle because their families are also struggling after the COVID recovery to be able to assist them to live comfortably.

“So one of the things we recognised is that we needed to have financial literacy training with our seniors to help them understand what are some of the precautions, first of all, they need to take against the depredations of abusers, because there are many people around who abuse the elderly because of their finances. [We want] to share with them what are some of the precautions that they need to take to ensure that those who are entrusted with helping them to pay their bills, are not unfairing them.”

Husbands also pointed out that retirement planning education is another important focus for the current administration. She said far too many Barbadians still believe that NIS is the only source of retirement funds they will ever require.

“We want to help them to understand that there is more that they can do in order to put aside something to help them through their retirement phase,” she said. “We want to do that not just with our seniors, but with middle-agers and with our young people. If they can start early, they are going to be able to amass sufficient funds that they should be able to take care of themselves in their old age and be able to live a comfortable life.”

(SB)